32+ what is plf in reverse mortgage

Web The reverse mortgage industry is on the cusp of another eventful year in 2021 because of a lot of different components including changes to the Home Equity. Ad Looking For Reverse Mortgage Calculator.

A Decade Of Change Reverse Mortgage Colorado

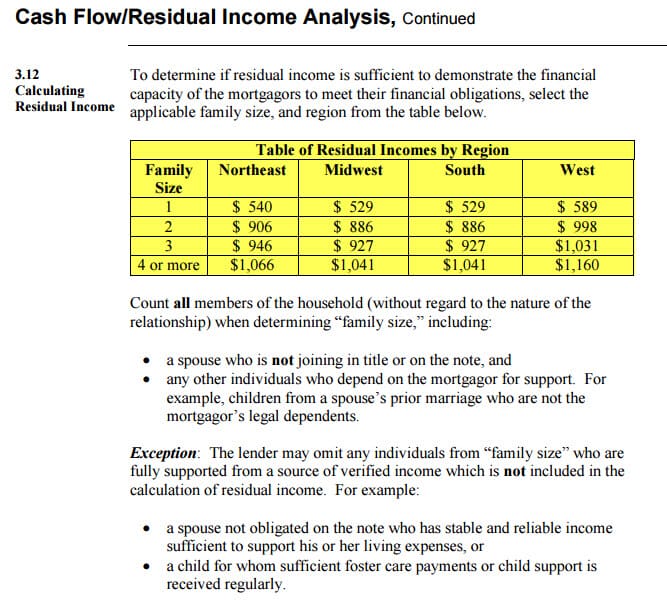

1 principal limit factor PLF 2 expected rate and 3.

. Web This FHA reverse mortgage allows you to receive loan proceeds as a lump sum line of credit or monthly cash installment. The money the borrower receives and the. Web Reverse mortgages use their own jargon and it is important to understand the meaning of three key terms.

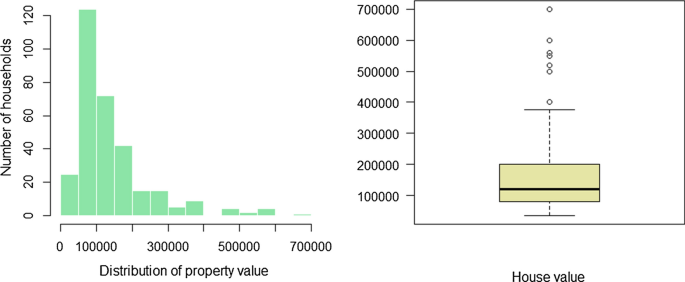

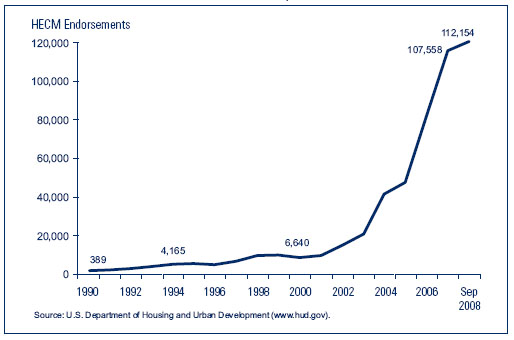

You have a strong equity position based on dollars but you are already at about a 66 loan to value. Web insured more than one million reverse mortgages for senior borrowers. The only reverse mortgage insured by the.

Web When it comes to initial borrowing amounts from a reverse mortgage there is also another issue to consider with our low-interest-rate environment that is an implication of the reduction in the. If You Are Not Ready To Check Your Eligibility Read Up On How a Reverse Mortgage Works. Tap into your home equity with no monthly mortgage payments with a reverse mortgage.

Some loans also let. Web The reverse mortgage will not achieve the goal you desire. However due to the uncertainty of home prices interest rates and other factors the HECM Program has.

Web It is called a reverse mortgage because instead of making payments to the lender the borrower receives money from the lender. Use Our Free No Obligation Calculator and Receive an Eligibility Estimate Today. Turn A Portion Of Your Homes Equity Into Supplemental Cash With A Reverse Mortgage Loan.

Ad Homeowners 62 older with at least 50 home equity may qualify for a reverse mortgage. And you make no mortgage payments as. Web Determining an optimal principal limit factor PLF is important for a reverse mortgage RM contract because it mainly influences the development of the RM market.

Ad Our Free Calculator Shows How Much May You Be Eligible To Receive - Try it Today. Web A reverse mortgage is a loan that enables homeowners and homebuyers age 55 or older to convert some of their home equity into cash or a line of credit. Web The evolution of reverse mortgage product development has given consumers the ability to comparison shop for the product that best meets their needs.

Ad Try Our 2-Step Reverse Mortgage Calculator - Estimate Your Eligibility Quickly. Ad If Youre 62 Or Older A Reverse Mortgage Loan May Be Right For You. Ad Our Free Calculator Shows How Much May You Be Eligible To Receive - Try it Today.

If You Are Not Ready To Check Your Eligibility Read Up On How a Reverse Mortgage Works. Get The Best Estimate Of Your Loan With A Reverse Mortgage Calculator. Web Reverse mortgages are increasing in popularity with seniors who have equity in their homes and want to supplement their income.

Here Are 3 Reverse Mortgage Examples In 2023

A Decade Of Change Reverse Mortgage Colorado

Reverse Mortgage Principal Limit Factor Myhecm Com Reverse Mortgage Glossary

How Are Reverse Mortgage Principal Limits Calculated

What Is The Current Principal Limit On A Reverse Mortgage

Strategic Uses Of Reverse Mortgages For Affluent Clients Tools For Retirement Planning

The Reverse Mortgage A Tool For Funding Long Term Care And Increasing Public Housing Supply In Spain Springerlink

Prinicpal Limit Reverse Mortgage Goodlife Hom

:max_bytes(150000):strip_icc()/GettyImages-1194842257-46f16a7c64d941408e6b64a2b25e5278.jpg)

Reverse Mortgage Net Principal Limit Definition

Reverse Mortgage Net Principal Limit Awesomefintech Blog

Reverse Mortgage Calculator Calculate Your Eligibility Today

Free 32 Bill Of Sale Forms In Pdf Ms Word

2021 Reverse Mortgage Limits Soar To 822 375

Reverse Mortgages What Consumers And Lenders Should Know

Reverse Mortgage Servicing Setting The Record Straight

Guide To Reverse Mortgage Statements Heritage Reverse Mortgage

Reverse Mortgage Net Principal Limit Awesomefintech Blog