35+ Mortgage extra repayment calculator

However borrowers need to understand the. However approvals surged to 403 thousand in June 2020 as businesses began reopening.

Pin On Hometalk Summer Inspiration

This calculator figures monthly mortgage payments based on the principal borrowed the length of the loan and the annual interest rate.

. That means the cash rate is now 235 per cent. It includes data from February 2020 to January 2021. Simply enter the loan details into the mortgage calculator below to see projected mortgage payments based on the type of home loan and your mortgage repayment frequency.

These are some of the most common uses of amortization. Your overpayment could be in the form of a one-off one lump sum or you could pay an extra amount each month on top of your usual repayments. The Comparison rate is based on a 150000 loan over 25 years.

Our chattel mortgage repayment calculator can help you estimate your monthly repayments total interest as well as amount payable. How to know when you can afford to buy an investment property. Microsoft Excel Mortgage Calculator Spreadsheet Usage Instructions.

If youre on a variable rate your repayments will probably increase too. Before lockdown was lifted in May 2020 UK mortgage approvals reached as low as 93 thousand. If youre on a fixed.

Help With Our Mortgage Balance Calculator. Interest is computed on the current amount owed and. Calculate how much youll save by overpaying your mortgage.

This gradually decreased to 989. By taking the time to understand what you can afford. Mortgage approvals reached its peak in November 2020 at 1049 thousand.

Early Repayment and Extra Payments. The calculator updates results automatically when you change. When you apply for a mortgage with us well give you whats called an Approval in Principle.

Mortgage Repayment Calculator Australia Use this calculator to generate an amortization schedule for your current mortgage. Almost any data field on this form may be calculated. For most people making extra mortgage repayments wins as savings rates are relatively low.

Please keep in mind that the exact cost and monthly payment for your mortgage will vary depending its length and terms. This comparison rate is true only for this example and may not include all fees and. This extra cost can offset any savings you make from overpayments.

Our Excel mortgage calculator spreadsheet offers the following features. The RBA has increased interest rates by 50 basis points to 235 per cent Use our calculator to see how much extra your mortgage repayments will be The Reserve Bank of Australia has enacted a fifth. Purchasing a property such as a house or unit can be quite profitable - especially if the purchaser takes their time to learn about how to reap.

Home Real Estate Mortgage Repayment Calculator Fixed Rate Mortgage Loan Calculator. Our mortgage calculator makes it easy to find out what the monthly fortnightly and weekly repayments will be for any loan. After the introductory period you can budget higher.

Our calculator can factor in monthly annual or one-time extra payments. The Reserve Bank of Australia RBA has increased the cash rate by 05 percentage points. Even 50 or 100 a month can dramatically reduce the interest you pay shorten your.

Using our Mortgage Balance Calculator is really simple and will immediately show you the remaining balance on any repayment mortgage details you enter. See how to use it. Thus its best to pay within the allowed amount which is usually 10 of your mortgage balance.

On the other hand early mortgage repayment comes with drawbacks. The results are based on a repayment mortgage. For a 30-year fixed mortgage with a 35 interest rate you would be looking at a 1078 monthly payment.

Making mortgage overpayments simply means paying more towards your mortgage than the amount set by your lender. Investing in property is often seen as the less risky form of investment unlike stocks or managed funds that can require specialised knowledge to get a foot in the door. Loan Amortization Calculator.

Mortgage overpayment calculator. Monthly repayments once the base criteria are altered by the user will be based on the selected products advertised rates and determined by the loan amount repayment type loan term and LVR as input by the useryou. This repayments calculator shows how much extra you may have to pay each month.

A part of the payment covers the interest due on the loan and the remainder of the payment goes toward reducing the principal amount owed. If youre on our Follow-on Rate Standard Variable Rate or a tracker rate mortgage you can make unlimited overpayments with no early repayment charge. You can even determine the impact of any principal prepayments.

Allows extra payments to be added monthly. Press the report button for a full amortization schedule either by year or by month. Enter the original Mortgage amount or the last mortgage amount when remortgaged Enter the monthly payment you make.

And the home becomes the security for the mortgage loan. Enter the appropriate numbers in each slot leaving blank or zero the value that you wish to determine and then click Calculate to update the. If you make overpayments during the introductory period be wary of early repayment charges.

Savings are rounded down to the nearest pound and year. Assuming you have a 20 down payment 60000 your total mortgage on a 300000 home would be 240000. That means the cash rate is now 185 per cent up from 135 per cent last month.

The interest rate will remain the same for the term of the mortgage. Overpaying can save you 10000s over the lifetime of a mortgage. Shows total interest paid.

In many situations mortgage borrowers may want to pay off mortgages earlier rather than later either in whole or in part for reasons including but not limited to interest savings wanting to sell their home or refinancing. Brets mortgageloan amortization schedule calculator. To use it all you need to do is.

If youre on a variable. Toggle menu toggle menu path dM526178 31. Basically a mortgage is a loan used to buy a home.

Calculate loan payment payoff time balloon interest rate even negative amortizations. And as the table shows overpayments dont have to be big bucks. When a borrower takes out a mortgage car loan or personal loan they usually make monthly payments to the lender.

This shows how much were able to lend you. Quickly see how much interest you will pay and your principal balances. A bank agrees to lend you money to buy build or renovate a home and you agree to repay it.

It also computes your total mortgage payment inclusive of property tax property insurance and PMI payments monthly PITI payments.

How To Save Money With Your Boyfriend Random Assets Of Life Saving Money Couple Finances Financial Planning Dave Ramsey

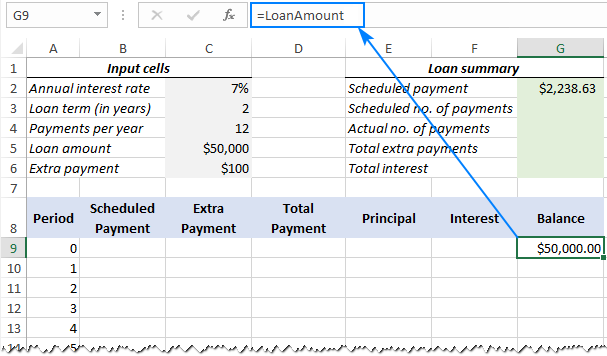

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

How Is Buying A House With A Mortgage A Good Investment If You End Up Paying Nearly Double Because Of The Interest 350k Loan 3 375 Total Is Over 500k By The End

How Best Can A Financial Statement Be Analysed Quora

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

Do You Want To Work From Anywhere You Can In 3 Easy Steps Job Employment Job Seeker

Why Is It Smart To Start Saving For Retirement When You Re In Your 30s Quora

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

Pin On Money Making Ideas

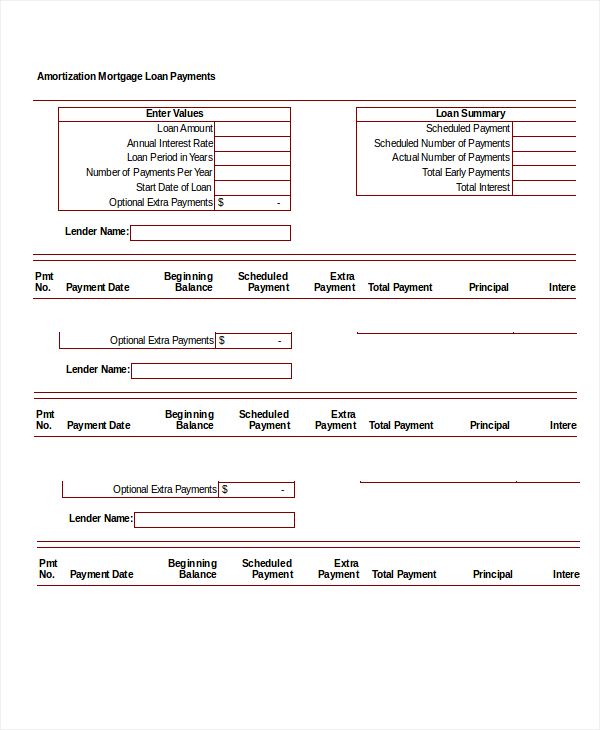

Free Amortization Schedule Free Pdf Excel Documents Download Free Premium Templates

Tables To Calculate Loan Amortization Schedule Free Business Templates

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

Tables To Calculate Loan Amortization Schedule Free Business Templates

I D Like To Learn The Math Behind Mortgage Interest Rates Where Should I Start Yes There Are Calculators But I D Like To To Learn How To Calculate The Interest Amounts Myself So

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed