Equity borrowing calculator

0207 158 0881 Portishead. STEP Calculator Results You can borrow up to 80 of the value of your home including up to 65 under lines of credit and other secured borrowing solutions.

Home Equity Line Of Credit Heloc Rocket Mortgage

With a Home Equity Line of Credit use the equity from your home to pay for your home improvement costs.

. Finally home equity loans almost make it too easy to overborrow. This Home Equity Available Credit calculator will help you estimate how much you may be able to borrow against your home equity. Home Equity loans can be easily figured using PNCs loan calculator.

FCFE CFO CapEx Net Borrowing. The Scotia Total Equity Plan STEP is a flexible borrowing plan tied to the equity in your home. Home Equity Lines of Credit Calculator Why Use a Heloc.

HELOCs act more like credit cards. The IBR Calculator allows users to perform a sensitivity analysis giving organizations the ability to assess the impact of these assumptions on lease portfolios. As such by borrowing that money you might lose out on a stream of income.

Interest expense is tax-deductible creating a tax shield whereas dividends to common and preferred shareholders are NOT tax-deductible. Put simply equity is the difference between the amount you owe on your home loan and the current value of your property. Our equity release calculator requires no personal details and provides you with 4 instant quotes.

Results provided by this calculator are intended for Illustrative purposes only and the accuracy is not guaranteed. This amount may not be the final amount you need to re finance your property and is used solely for the purpose of providing you with an indication of the loan amount you may require the upfront costs you may incur. The maximum lowest rate average medically enhanced.

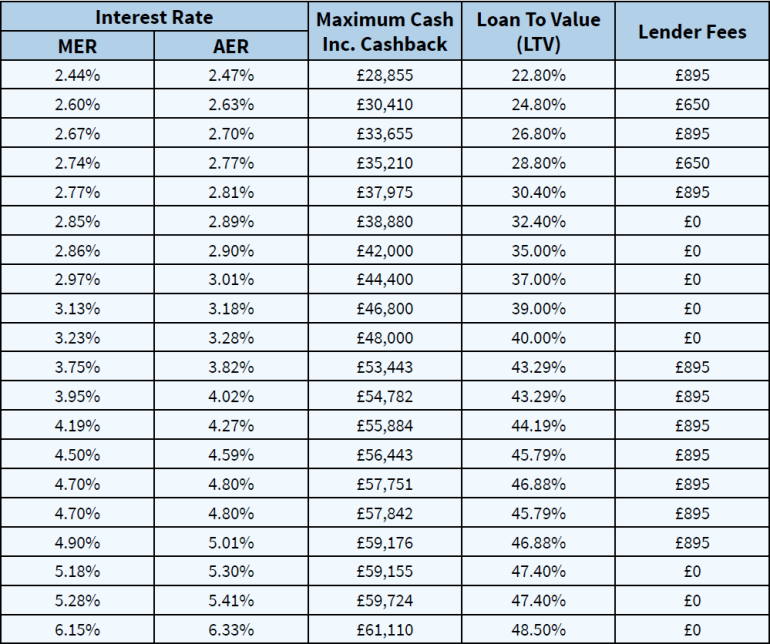

Rather than borrowing a specific sum of money and repaying it a HELOC gives you a line of credit that lets you borrow money as needed up to a certain limit. Think of it as a maximum borrowing power calculator helping you work out what a bank takes into consideration to ensure you could repay your home loan and meet your other outgoings. Simple registration fast access The product enables generation of IBR for multiple lease currencies and up to 100 years lease tenors within minutes.

You can access the equity in your home to finance things like a car tuition or to pay for a wedding. Citizens offers Home Equity Lines of Credit as low as 17500 but terms may vary. 4 min read Aug 18 2022 Home equity loan or HELOC vs.

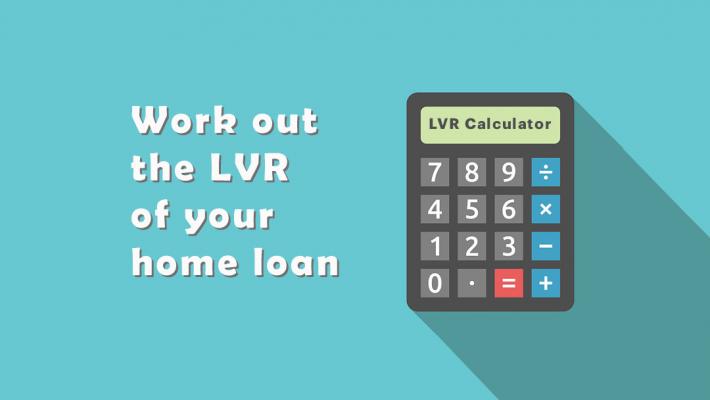

ROE shows how efficiently the companys management is allocating its capital. Loan repayments are based on the lowest interest rate either standard variable or 3-year fixed rate owner occupier from our lender panel over a repayment period of 30 years. Rates and repayments are indicative only and subject to change.

The cost of equity is higher than the cost of debt because the cost associated with borrowing debt financing ie. Use our payment calculator above or use the below formula. Do you wish to calculate the useable equity in your current.

STEP lets you choose from different kinds of Scotiabank credit products like mortgages lines of credit credit cards and more based on your needs all with one easy application. Your actual results may vary. It allows home owners to borrow against.

Is a special type of home equity loan. Our equity release calculator allows you to see how much tax-free cash you could unlock from your home. A home equity loan gives you all the money at once with a fixed interest rate.

Because theyre a cinch to qualify for provided your. This is called your borrowing power. The borrowing amount is a guide only.

This calculator helps you work out the most you could borrow from the bank to buy your new home. Recall CFO is calculated by taking net income from the income statement adding back non-cash charges and adjusting for the change in NWC so the remaining steps are to just account for CapEx and the. Contact Money Release Simply click on the links below London.

In general the cost of equity is going to be higher than the cost of debt. You can borrow what you need as you need it up to a certain limit. When buying a second home you could use some or all of the available equity in your current property as a deposit for your new loan.

FCFE Formula CFO FCFE In the next approach the formula for FCFE starts with cash flow from operations CFO. Return on equity can be calculated by dividing net income by average shareholders equity and multiplying by 100 to convert to a percentage. Because the home is more likely to be the largest asset of a customer many homeowners use their home equity for major items such as home improvements education or medical bills rather than day-to-day expenses.

A home-equity loan also known as an equity loan a home-equity installment loan or a second mortgage is a type of consumer debt. 1 With STEP youre in control. When borrowing large sums of money many borrowers choose cash out refi rather than a home equity loan.

Unlike a mortgage or home loan its a flexible line of credit and you can use it only when you need to. Whether planned or unplanned large purchases or expenses can throw a wrench in your budget. The loan amount has been calculated based on the information input by you and information sourced by third parties.

Then the only monthly payment you have to pay is the interest. So you can be sure you are borrowing the right amount. A home equity line of credit is a type of revolving credit in which the home is used as collateral.

Disclaimer - Borrowing power. A home equity line of credit or HELOC allows you to borrow against the equity of your home at a low cost. Key have helped over 1 million people decide if equity release is right for them and continue to help plenty of customers enjoy a better retirement.

Home equity borrowers can deduct interest but only if they meet these requirements. Simply answer a few questions and find out how much you qualify for easily. The property securing the CHELOC must be located in a state where PNC offers home equity products.

Tax Benefits of Homeownership Before the 2018 tax bill passed homeowners could deduct the interest expenses on up to 100000 of debt from home equity loans HELOCs but interest on these loans is no longer tax deductible unless it is. Return on equity represents the percentage of investor dollars that have been converted into earnings. Try our HELOC calculator or request an instant offer today.

Remember the interest youll pay on a home equity line of credit will add to the overall cost of any purchase. This calculator is intended for informational purposes only and is not intended to provide todays actual rates. We can show you how to unlock equity in your home to achieve the goals that you have now and in the future.

For example say your home is worth 350000 your mortgage balance is 200000 and your lender will allow you to borrow up to 85 of your homes value. Home equity loan calculator. PNC does not offer the CHELOC product in Alaska Hawaii.

Mortgage Formula With Graph And Calculator Link

Home Equity Calculator Free Home Equity Loan Calculator For Excel

Lvr Borrowing Capacity Calculator Interest Co Nz

Home Equity Calculator Free Home Equity Loan Calculator For Excel

Home Equity Loan Calculator Mls Mortgage Home Equity Loan Calculator Home Equity Loan Mortgage Amortization Calculator

Equity Release Calculator No Personal Details Required

Home Equity Loans Selco

15 Year Mortgage Calculator Calculate Local 15 Yr Home Loan Refi Payments Nationwide

Home Equity Loan Calculator Nerdwallet

Home Equity Calculator Free Home Equity Loan Calculator For Excel

Heloc Calculator

Home Equity Calculator Free Home Equity Loan Calculator For Excel

Home Equity Guide Borrowing Basics Third Federal

What Is Home Equity How To Determine The Equity In Your Home Zillow

How To Calculate Equity In Your Home Nextadvisor With Time

Home Equity Loan Calculator By Creditunionsonline Com Calculate Home Equity Loan Payments

The Difference Between A Home Equity Loan And A Home Equity Line Of Credit Palisades Credit Union